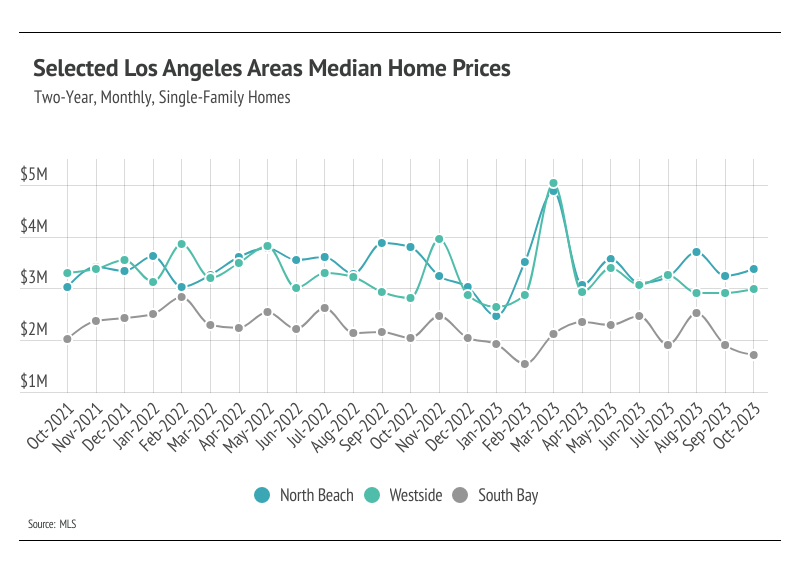

It can be hard to understand the Los Angeles real estate market by watching national trends. And it can be deceiving to try to figure out what's happening in your neighborhood by looking at Los Angeles as a whole because each neighborhood can be its own universe.

So for our market report that we'll update monthly, we've divided Los Angeles into three luxury real estate areas as follows:

- North Beach area, including the Pacific Palisades, Santa Monica, and Venice.

- Westside, including Beverly Hills, Brentwood, West Hollywood, and Westwood.

- South Bay, including Hermosa, Manhattan Beach, and Redondo.

Quick Take:

-

The median single-family home prices and average price per square foot were mixed across markets from September to October. Price per square foot gives a more accurate picture for the selected areas. Year over year, North Beach and the South Bay are flat, while the Westside is up 4% in terms of price per square foot.

-

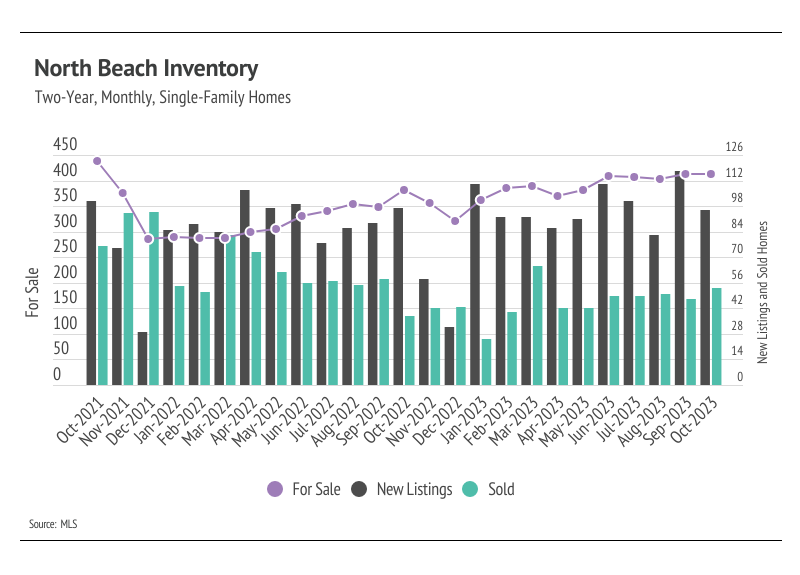

In the selected markets, only North Beach inventory and sales rose year over year. The South Bay sales notably dropped in October, but this is most likely an outlier month, which happens from time to time.

-

Buyers have been negotiating harder as the cost of financing rose higher over the past three months, and sellers are receiving a smaller percentage of asking price on average.